So, your credit score isn’t ideal, but there’s no need to feel bad about it. According to Experian, 16% of Americans have very poor credit. I can relate—I once had a credit score of 350, but that’s ancient history now. Fortunately, you’re on the right path by exploring credit repair books to learn how to improve your situation.

The best part? You can do this without taking on the recurring costs of credit repair services, which have the potential to exacerbate your financial struggles. All you need to do is educate yourself and put the knowledge into action.

So, what are the best books on credit repair?

In this comprehensive guide, you’ll get to see the best credit repair books of all time and where to find credit repair books and other resources for free. I’ll also address some of the most common questions people ask about credit repair.

Here’s what’s in store:

Below, you’ll find the best credit repair books, why they’re great, and a quick summary of what each one is all about.

Credit Secrets honestly shines because it covers everything you need for credit repair – It’s like a one-stop-shop that tackles:

The best part? It works! Loads of folks have seen their credit scores shoot up using Credit Secrets’ strategies…even those in super complex situations.

So, who’s it perfect for? If your credit situation is a bit of a puzzle, you need quick results, and you want a surefire method, this book is going to be your jam.

Credit Repair for Dummies is a popular credit repair book that offers a straightforward and easy-to-understand approach to fixing credit issues. It provides readers with practical tips and strategies for repairing and improving their credit scores.

This book covers topics such as understanding credit reports, disputing errors, dealing with creditors, and rebuilding credit.

Credit Repair for Dummies book is an excellent choice for beginners’ to learn about credit repair. It is written in an accessible and user-friendly manner. It’s suitable if you don’t have an in-depth understanding of credit, but want to take steps to repair your credit history.

Hidden Credit Repair Secrets is a valuable credit repair resource due to its deep insights into credit improvement strategies and insider knowledge – This book delves into some of the intricacies of credit reporting, to help readers:

It provides practical tips and techniques to challenge negative items on your credit report, negotiate with creditors, and establish healthy financial habits.

This book is particularly beneficial for individuals facing credit challenges, such as those with low credit scores, derogatory marks, or a lack of credit history.

The Easy Section 609 Credit Repair Secret focuses on one specific and powerful credit repair tactic. This book centers around the Section 609 credit dispute letter, which is a legal tool to challenge inaccurate information on your credit report.

Corder provides a clear and straightforward guide on how to use Section 609 effectively, making it accessible for individuals without a deep understanding of credit repair. This book is ideal for those looking for a concise and actionable method to address credit issues, especially if they’ve encountered difficulties in removing inaccuracies through other means.

This book offers a specific and powerful approach to credit repair, making it particularly attractive to those who prefer a focused and efficient method to address credit problems.

The Credit Repair Black Book is another valuable credit repair resource for a couple reasons:

For one, this book provides insights and strategies directly from an industry insider, Mark Kennedy, who has 20 years of experience in credit and financial services – Kennedy’s insider knowledge allows him to unveil credit repair secrets and strategies that might not be readily available to the general public.

Moreover, the book is written in an easy-to-understand style, ensuring that readers of all backgrounds can grasp the essential concepts of credit repair.

It’s particularly suitable for individuals who want to take control of their credit situation and work toward a better financial future. Ultimately, anyone seeking to boost their credit scores and gain financial stability could benefit from the insights.

Make a Plan, Improve Your Credit, Avoid Scams is highly regarded for its clear and practical guidance on repairing and improving credit. The authors not only provide valuable insights into understanding credit reports and scores but also offer actionable steps to take control of one’s credit health.

What sets this book apart is its emphasis on creating a personalized plan to address individual credit issues. It encourages readers to develop a strategic approach tailored to their unique circumstances, making it an excellent resource for those seeking a customized credit repair strategy.

This book is particularly relevant to those who want to not only repair their credit but also protect themselves from common credit-related scams and pitfalls. It equips readers with the confidence to address credit issues head-on.

The Total Money Makeover is not specifically a credit repair book, but it’s a comprehensive personal finance guide. It focuses on debt reduction, financial management, and building wealth.

While it doesn’t primarily target credit repair, it offers valuable advice on getting out of debt, which can indirectly lead to improved credit scores – This book is ideal for individuals looking to gain control of their finances, pay off debt, and build a strong financial foundation.

Those who follow its principles will likely experience positive changes in their credit scores as they pay off outstanding debts and practice responsible financial management. However, for individuals solely focused on credit repair, they might benefit from books specifically tailored to that topic, providing step-by-step strategies for improving their credit history.

While not as in-depth about credit issues as some of the others on the list, The Money Book for the Young, Fabulous, and Broke provides valuable financial advice. It’s a great read if you’re looking to manage your overall financial situation. And, there is a great section dedicated to credit repair.

Again, this is not primarily a credit repair book, but it provides comprehensive financial guidance, including advice on managing debt, building credit, and improving financial well-being. It covers some of the most common credit-related topics.

Young adults and anyone seeking practical financial advice — even those with poor credit scores — should check it out.

While I am truly a fan of investing in yourself to improve your situation, I realize that you don’t always have extra cash to spend on books – this might be especially true if you’re already in debt. So, where can you find legitimate credit repair resources for free?

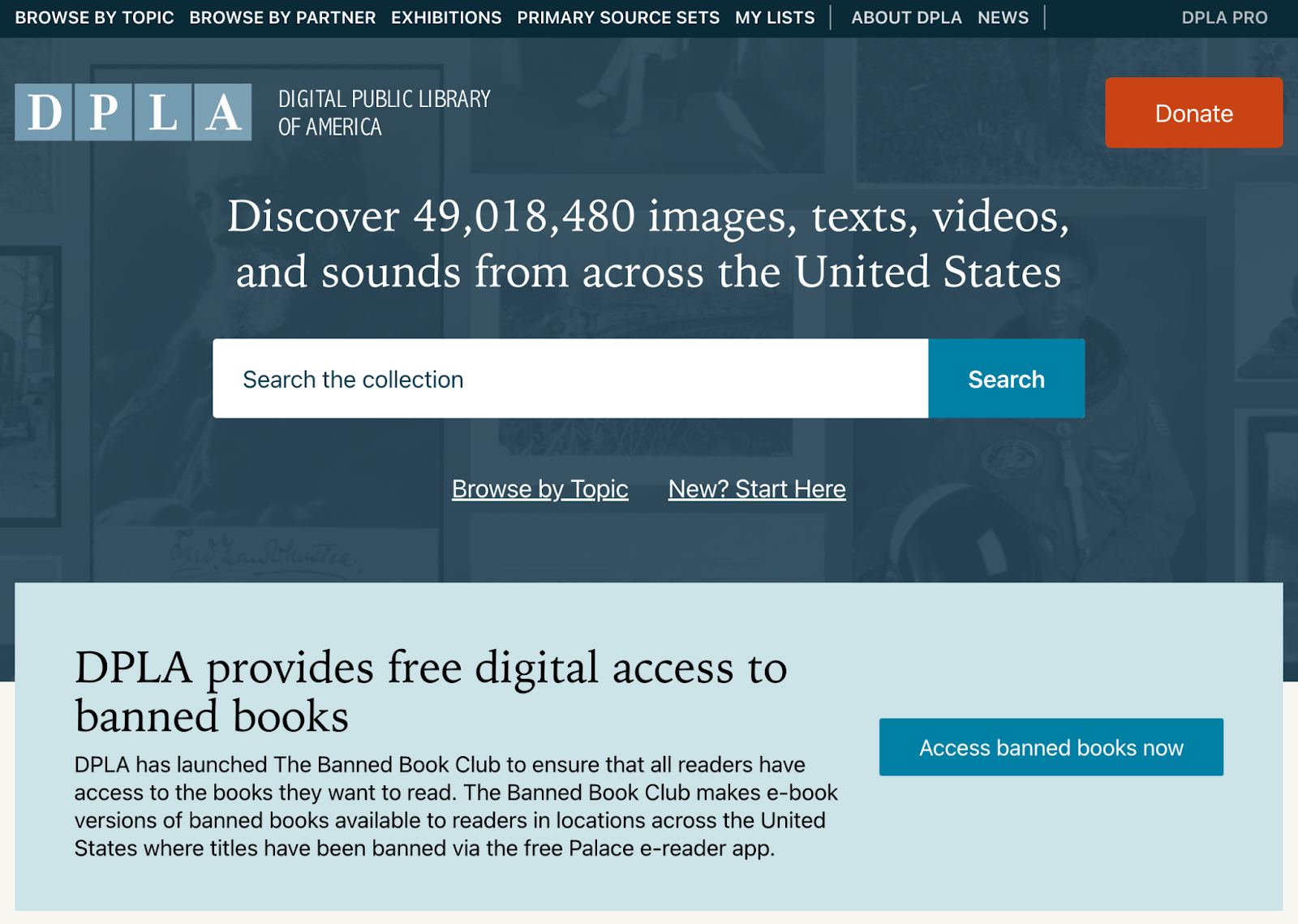

Here are some places you can find reputable credit repair books and tools for free (Aside from the

These platforms are worth checking out for anyone seeking free credit repair materials and information to improve your financial well-being – Collectively, they provide a wealth of knowledge to help you understand credit repair concepts and take actionable steps to enhance your credit profile without the need for costly services.

Credit repair starts with understanding your credit report, disputing errors, and developing good financial habits. Credit repair books can provide you with step-by-step guidance.

Is paying for credit repair worth it?Paying for credit repair services may not be worth it when you have excellent resources available in books. They empower you to take control of your credit repair journey without trusting your fate to a stranger.

Does credit repair hurt your credit score?Credit repair, when done correctly, should never harm your credit score. Good credit repair aims to remove errors and improve your credit history – This doesn’t mean that all credit repair services and offers should be trusted, and you need to be wary of scams.

What is the best way to repair your credit?The best way is to implement a personalized strategy to address errors on your credit report and establish positive financial habits, as suggested in most credit repair books. Keep in mind that you need to cater your credit repair plan to your unique situation.

In your journey to repair your credit, Credit Secrets stands out as an invaluable resource. It covers everything you need to know, and it doesn’t cost you monthly fees. For a broader financial perspective, consider Suze Orman or Dave Ramsey’s books.

And, don’t be afraid to check out the other books listed here as well as explore the free resources available to you – knowledge is power. The right choice boils down to how complex your credit issues are, how fast you want to solve them, and what’s left in your piggy bank.

To dive into the world of credit repair and get that credit score up fast so you can move forward with your life, check out Credit Secrets and start your journey to better financial health.

Ashley Kimler is your friendly Credit Secrets wordsmith. With a knack for turning complex money matters into easy-to-digest advice, Ashley has been a trusted voice in the world of finance. With writing credits from Pangea Money Transfer, Centier Bank, Performio, and more, she's here to help you navigate the financial jungle with a dollop of wisdom. Let's turn sense into dollars together!

ASAP Credit Repair Review" width="2240" height="1260" />

ASAP Credit Repair Review" width="2240" height="1260" />

![]()

Credit Secrets is dedicated to providing comprehensive resources for boosting your credit score. Our proven strategies have helped countless people improve their financial health and credit rating, empowering them to achieve their life goals.