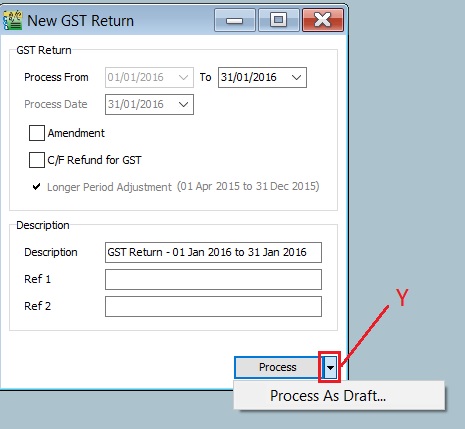

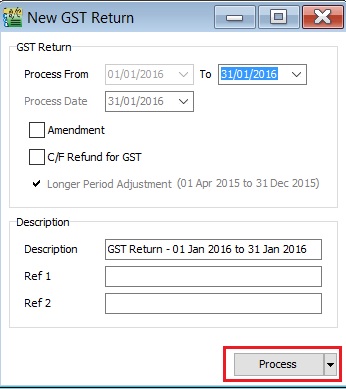

You are able to draft the GST-03 before the final GST-03 submission by process as draft.

1. Click on the arrow key down at the Process button (Y). 2. See below screenshot.

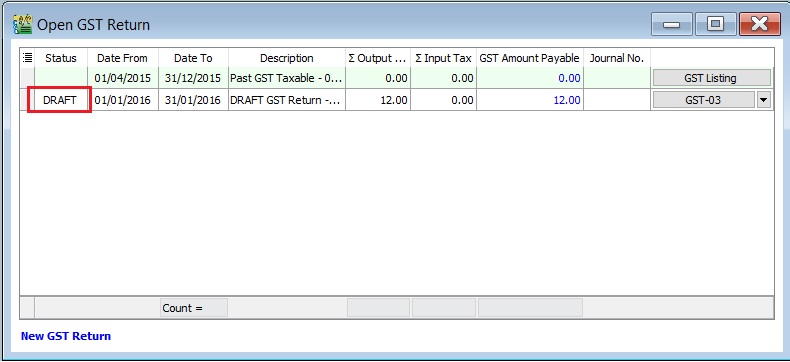

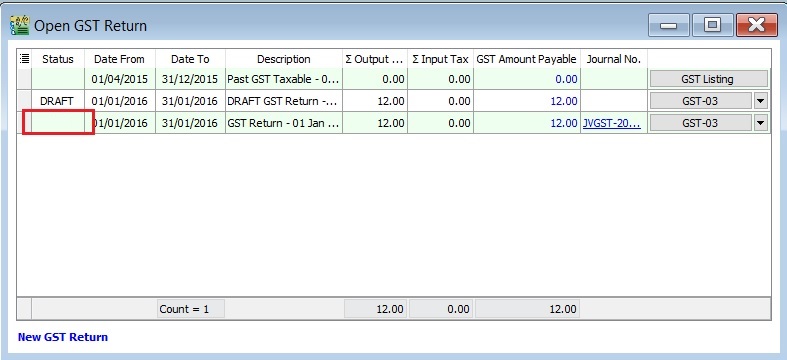

3. DRAFT Status showed for the GST Returns period.

Note: You still can amend the documents where the DRAFT GST return has generated. You can draft as many before FINAL process the GST Returns for the period.

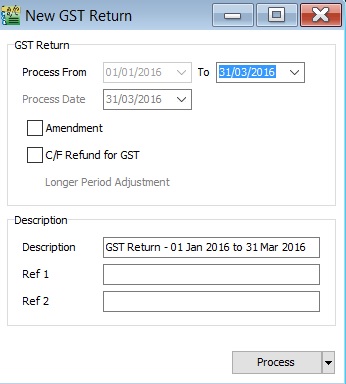

[GST | New GST Return. ]

1. Click on the Process button. 2. See below screenshot.

3. Final GST Return will not show the word DRAFT in the status column.

Note: You cannot amend the documents anymore where the FINAL GST return has generated.

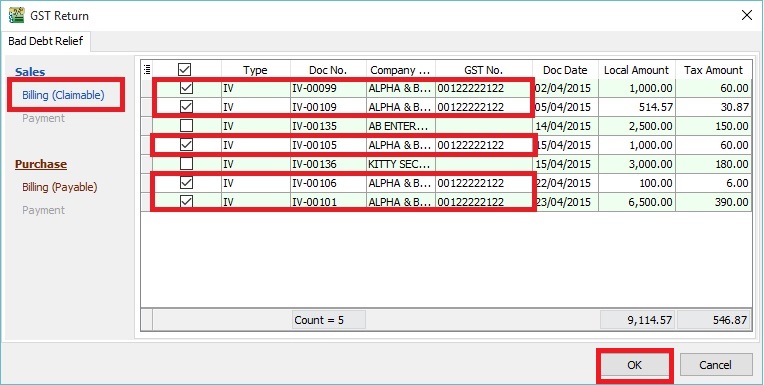

1. Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months.

2. Sales documents from the company with empty GST No will be unticked. You can tick the documents if you think this company is a GST Registered person.

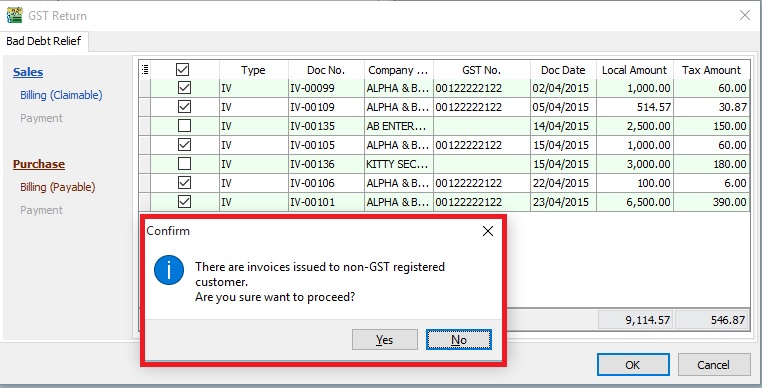

3. Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No.

4. If you has confirmed that the company is Non-GST Registered person then you can press YES to proceed.

5. Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a GST Registered person before process the GST Return.

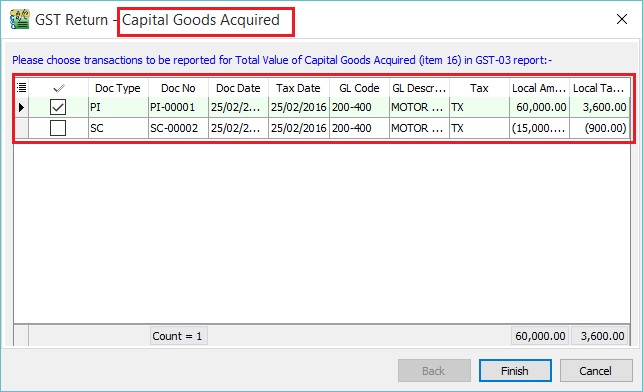

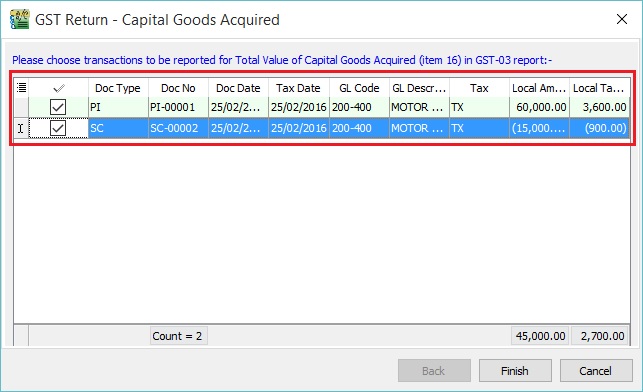

1. If you have get a prompt for the GST Return - Capital Goods Acquired, then it means there have some credit adjustment transactions for Fixed Asset Account. See below screenshot.

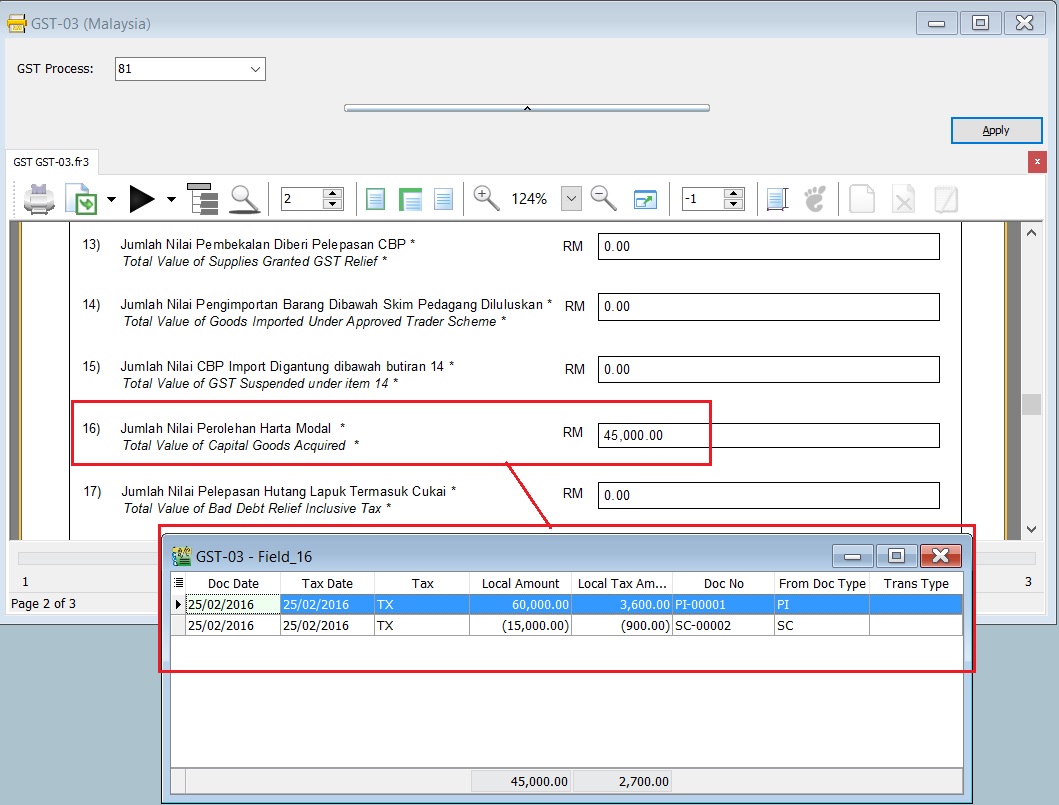

2. Tick on the transactions line to take in the credit adjustment (eg. Rm15,000.00). Otherwise, it will capture the value Rm60,000.00 in GST-03 item 16. See the screenshot below.

3. It will capture the net capital goods acquired value in GST-03 item 16.